Insurance companies, like many businesses, can benefit greatly from digital transformation. Digital transformation in the insurance industry is increasing year over year. Insurance is an information driven business. Information centric businesses typically make excellent candidates for leveraging AI and automation. In this article we will cover some of the specific challenges to insurance companies, digital transformation for insurance firms and brokers, what a digital insurance company looks like, and some of the best tasks to automate in an insurance company.

Specific Challenges to Insurance Companies

Many of the challenges facing the sector can be solved with insurance digital transformation. Staffing is one issue we hear about from many of our clients in this space. Automation can offload work and also make human workers more efficient. Improving back office efficiency gains is another common challenge we hear, as is increasing profitability and driving down costs. Digitization and digital transformation have been taking hold in the industry (particularly at larger companies) and leading to globalization of the space. Brokers and providers are increasingly facing more competition and consumers have more choice for insurance options. There are new entrants, digital only companies, plus vertical integration occurring. The best way to thrive in this environment is to lean into insurance digital transformation and become a digital insurance company.

Digital Transformation for Insurance Companies

What exactly comprises digital transformation in the insurance industry? We find that three common technologies address all the needs of the sector when it comes to digital transformation.

RPA (robotic process automation) is a valuable tool and is behind software bots that can perform routine, rules based, and mundane tasks. Typically, there are many of these in insurance firms and brokers. If they occur in high volume, they make great candidates for insurance digital transformation.

Cognitive AI is another tool commonly deployed for digital transformation in the insurance industry. Conversational AI processes and translates human spoken or written word communication with software applications. It is used in chat bots, web tools, and also to gather information for human workers when they work hand in hand with the AI to perform better, faster, and more efficiently.

Cognitive AI is one more tool we find in digital transformation for insurance. Cognitive AI often takes the form of OCR or optical character recognition tools and allows the digital processing of documents and forms. Cognitive AI learns over time and gets better at tasks. Documents are the lifeblood of todays information age companies … and insurance companies have plenty of them.

The Digital Insurance Company

Becoming a digital insurance company equates to making sure that what can be automated is, and what can be digitized is transformed. Many tasks can be completely offloaded with digital transformation. RPA, Conversational AI, or Cognitive AI can assist other tasks and workflows. Workers in a digital insurance company will be doing work that only a human can do. They will also be assisted by AI and automation wherever possible. A digital insurance company will be lean and efficient. It will be more profitable and better able to compete locally and globally. All insurance companies should leverage all digital tools at their disposal … If they do not their competitors will. At Valenta we are here to help with digital transformation for insurance. In particular, we want to help small and midsized firms and brokers compete against larger entities already using this technology.

Current Status of Digital Transformation in the Insurance Industry

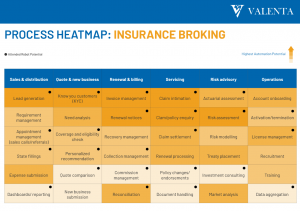

If there are high volume tasks that are rules based there is a high probability they can be automated with a bot using RPA. Human workers can also be made more efficient using digital transformation with RPA or Conversational AI software. Large enterprises and the Fortune 1000 have been spending on RPA and AI for at least the last decade. Below is a heatmap highlighting some common processes that lend themselves to automation or AI assisted human in the loop deployments of digital transformation for insurance.

About Valenta

At Valenta we are bringing global experience to digital transformation for insurance. We have access to rich AI and digital transformation talent pools offshore. We also provide a team of local managing partners in cities, states, and provinces close to our clients. We have regional managing partners with expertise in automation and insurance to assist with all our engagements. At Valenta we are 100% focused on SMB clients. We help our clients address challenges with growth, process, profits, execution, innovation, strategy, AI & automation, staffing, and digital marketing. We are able to address all of these common challenges with our core services of Process Consulting, Digital Transformation, Staff Augmentation and Learning Platforms. Please feel free to contact one of our local Managing Partners to discuss if digital transformation can help automate your insurance business.